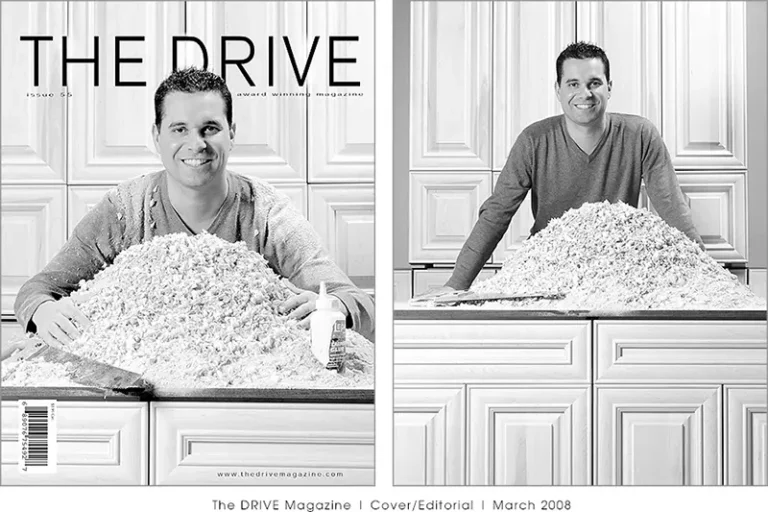

by Michael Piccioni

We are currently living in historic times due to economic uncertainty and geopolitical turmoil. Residual effects of Covid 19, bank failures in the US, War in Ukraine, countries leaving the US dollar for trade, and inflation at 40-year highs are all topics that keep us up at night. What will happen to our dollar? Our investments? Our money in our banks? How can we protect ourselves and our family wealth from what is to come with all the current uncertainty in the world today?

In times like these, investors often turn to precious metals such as gold and silver as a haven to protect their wealth. Recent events have highlighted the importance of investing in precious metals as a hedge against these risks.

First, let’s take a look at the recent bank failures. In recent years, there have been several high-profile bank failures around the world, from the Lehman Brothers collapse in 2008 to the recent collapse of Silicon Valley Bank. These events have shown that even large, seemingly stable financial institutions can fail, leaving investors with significant losses. Precious metals, on the other hand, are not subject to the same risks as paper assets such as stocks and bonds. As a physical asset, gold and silver hold their value and cannot be wiped out by a bank failure.

Next, let’s consider the issue of high inflation. Inflation has been on the rise in many countries around the world, with some countries experiencing the highest levels of inflation in decades. Inflation erodes the value of paper currencies, making it harder for investors to maintain their wealth. However, gold and silver have historically been a good hedge against inflation. When inflation rises, the value of gold and silver tend to increase, making them a good way to protect against inflation.

Countries moving away from the US dollar is also a cause for concern. The US dollar has long been the dominant currency for international trade and has been viewed as a safe haven for investors. However, in recent years, several countries, including China and Russia, have been moving away from the US dollar and diversifying their reserves into other currencies and assets such as gold. This trend could potentially weaken the US dollar’s status as the world’s reserve currency, leading to further economic uncertainty and potentially higher inflation. In this scenario, gold and silver could once again prove to be a safe haven for investors.

Finally, the ongoing conflict in Ukraine has also highlighted the importance of investing in precious metals. Geopolitical risks can have a significant impact on financial markets, causing volatility and potentially leading to losses for investors. Precious metals, however, are not subject to the same risks as paper assets and can provide a buffer during times of geopolitical uncertainty.

Overall, the above factors show why investing in precious metals can be crucial in today’s economic climate. There are several reasons why investors may choose to invest in gold and silver:

- Portfolio diversification: Investing in gold and silver can provide a level of diversification for an investment portfolio, reducing overall risk and improving returns. Precious metals have a low correlation with other asset classes, meaning their prices often move independently of stocks and bonds.

- Store of value: Gold and silver have been recognized as a store of value for thousands of years. Unlike paper currencies, which governments or central banks can devalue, precious metals cannot be printed or created at will, giving them inherent stability and value.

- Currency hedging: Countries moving away from the US dollar could lead to further currency fluctuations and uncertainties. Investing in gold and silver can act as a hedge against these currency risks, providing protection against potential losses due to exchange rate fluctuations.

- Liquidity: Gold and silver are highly liquid assets that can be easily bought and sold on global markets. This allows investors to quickly convert their holdings into cash if needed, providing financial flexibility that may not be available with other investments.

- Tangible asset: Precious metals are tangible assets that can be held physically, providing a sense of security and ownership that may not be present with paper assets such as stocks or bonds.

The current economic landscape presents numerous challenges for investors, making it crucial to consider alternative investment options such as gold and silver. By investing in precious metals, people can protect their wealth from various risks, including bank failures, high inflation, currency fluctuations, and geopolitical uncertainty.

Additionally, gold and silver offer portfolio diversification, liquidity, and a tangible store of value, making these a valuable addition to any investment strategy. As we continue to navigate these historic times, investors need to remain proactive and explore all available options to safeguard their financial future.

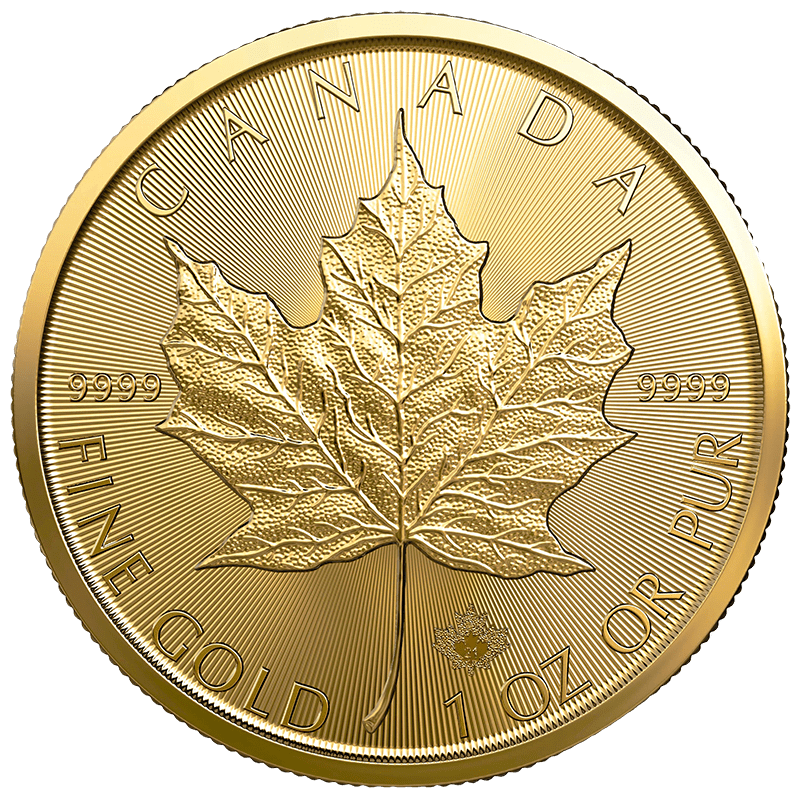

CanAm Currency Exchange is a leading authorized dealer with the Royal Canadian Mint, offering the best prices in Canada guaranteed on a vast range of precious metals. With an extensive inventory that includes private and government-minted bars, coins, and rounds, CanAm takes pride in catering to the diverse needs of its clientele. Conveniently located on Dougall Ave, CanAm’s team of precious metals experts are always available for free in-person consultations, ensuring clients receive personalized guidance and advice to make informed decisions about their investments.